Why Mncs Are Quitting India

Holcim Group, with headquarters in Switzerland, is the latest MNC to abandon India due to macroeconomic and regulatory concerns and focus on their core businesses.

In announcing the sale of its India subsidiaries - Ambuja Cements and ACC - Holcim said that it was doing so to focus on green revenue as it intends to reduce its exposure to the carbon-intensive cement sector and increase its environmental, social, and corporate governance (ESG) credentials. The company has also sold cement assets in Brazil, Russia, Malaysia, Sri Lanka, and Northern Ireland.

The long list of companies that quit India in the past included Cairn Energy, Lafarge, Hutchison Telecommunications International, Docomo, Carrefour, Daiichi Sankyo, and Henkel. Foreign banks on the list include Royal Bank of Scotland, Citi, and Barclays, focusing entirely on wholesale banking in the country.

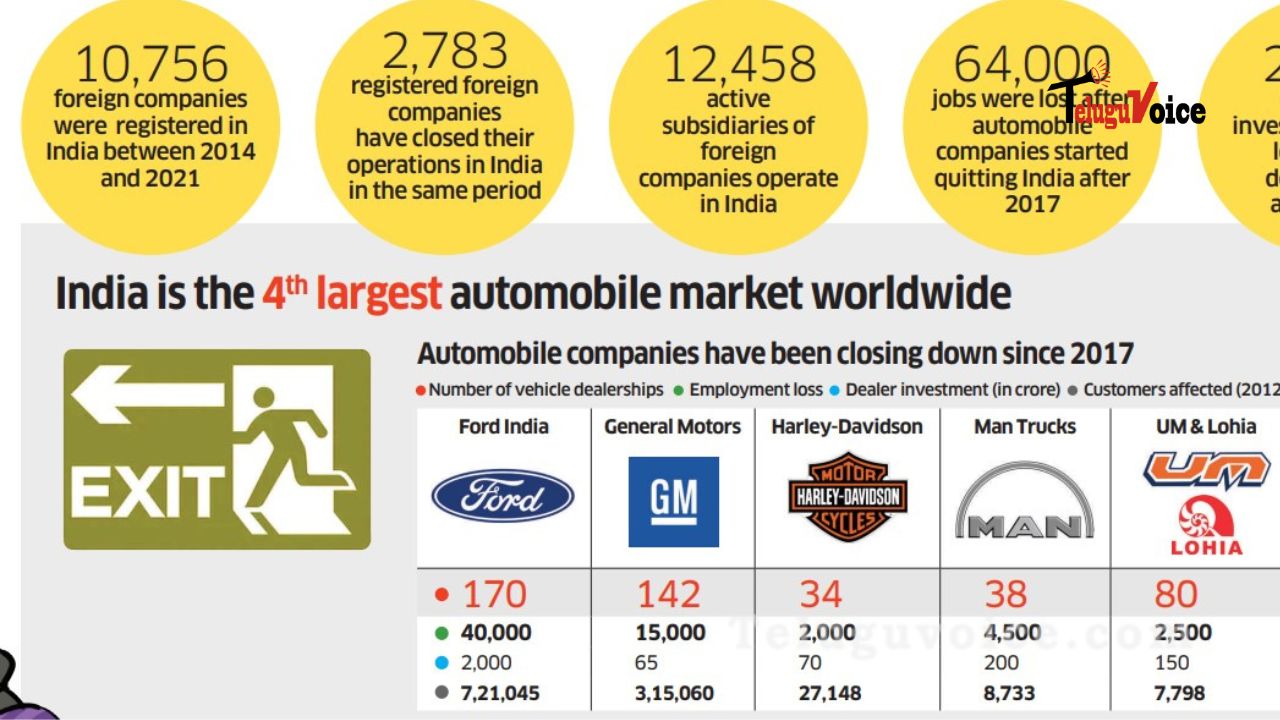

In December 2021, Piyush Goyal, Commerce and Industry Minister, informed the Lok Sabha that between 2014 and November 2021, 2,783 foreign companies and their subsidiaries closed operations in India.

As many as five automobile MNCs – Ford India, Harley Davidson, UM & Lohia, Man Trucks, and General Motors – exited India during the past five years, apart from erosion of dealer investments worth Rs 2,485 crore, which also resulted in nearly 64,000 job losses.

“Some auto companies had originally set up businesses in India, thinking the country would be a dump yard for their products that were not selling in global markets. At that time, Indian companies were not making products that could compete with the quality of these MNCs. While most of these foreign companies did not keep Indian conditions or customers in mind, slowly and steadily, domestic firms also started making quality products,” Vinkesh Gulati, president of the Federation of Automobile Dealers Associations of India (FADA), said.

“There were no regulatory or political concerns that would have hurt them. The move has hurt both dealers and customers as there are no services for the products they have sold in the country, which has resulted in huge job losses, too,” he added.

With domestic markets maturing and government initiatives such as ‘Make in India’ and ‘AatmaNirbharBharat Abhiyan’ gaining ground, India is increasingly becoming a difficult market for MNCs.

“Before making a strategic acquisition or setting up an India vertical, it is imperative that MNCs gain a sound understanding of the local regulatory and operational aspects of the industry they operate in. Hence, they should look at partnering with domestic players and understanding the environment better, get the right local talent and then potentially take sole control,” Shivam Bajaj, founder and CEO at private equity and M&A advisory firm Avener Capital said.

The exits also came when the Centre and various state govts were rolling out red carpets, with sops such as tax holidays, for MNCs looking to shift their base from a pandemic-battered China.

According to a Parliamentary Standing Committee report tabled in February 2021, for companies going out of China, India falls behind countries such as Taiwan, Thailand, Vietnam, as preferred destinations.

South Africa tour of India 2019

South Africa tour of India 2019

Comments